An Introduction to Interval Funds

An interval fund is a type of closed-end fund that allows investors to sell their shares back to the fund at regular intervals.

An interval fund is a type of closed-end fund that allows investors to sell their shares back to the fund at regular intervals. It is designed to provide investors with the potential for higher returns than traditional open-end funds, while also providing liquidity and capital preservation.

Primary Advantages

Interval funds are structured differently from conventional closed-end funds, as they typically issue new shares periodically and allow shareholders to redeem shares on predetermined dates or through special redemption requests. The primary advantages of investing in an interval fund include access to investments otherwise unavailable or difficult to buy directly, diversification benefits, more flexibility than traditional long term investments such as stocks and bonds, and lower fees compared to actively managed mutual funds.

Structure & Mechanics

An interval fund typically offers a diversified portfolio of investments such as stocks, bonds, and other securities. Shares are allowed to be redeemed from the fund at specified intervals that can range from monthly to annually depending on the terms of the fund. If there is not enough cash in the fund at a redemption date, either existing shareholders may have their shares repurchased at a discount or new investors will not be able to purchase additional shares until new money is deposited into the fund from outside investors.

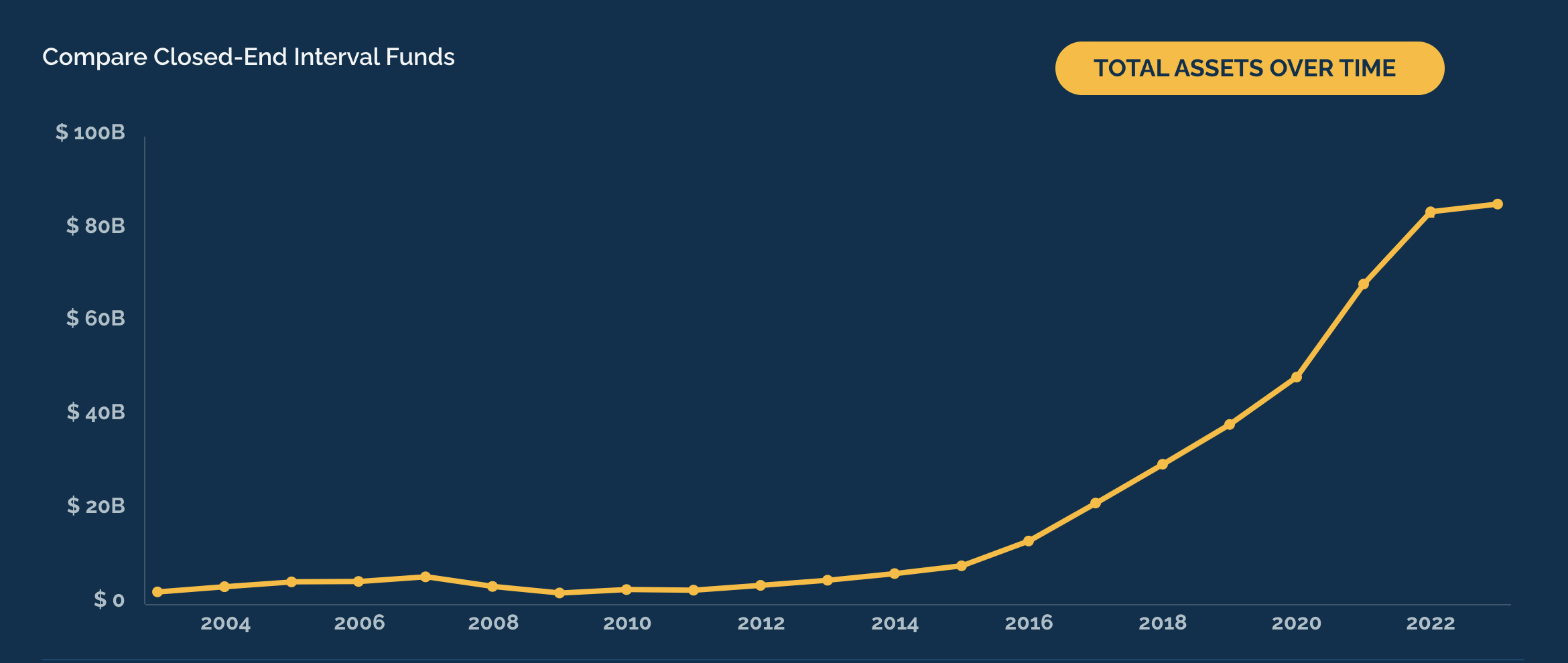

Assets Under Management

As of June 30, 2023, the total AUM of interval funds is $86 billion. This represents a significant increase from the end of 2022, when the total AUM was $63.5 billion. The growth of the interval fund market is being driven by a number of factors, including the increasing demand for liquidity and yield among investors.

Here is a breakdown of the total AUM of interval funds by asset class:

- Private Credit: $42.2 billion

- Real Estate: $23.2 billion

- Private Equity: $10.2 billion

- Others: $10.4 billion

The largest interval fund is the ACAP Strategic Fund, which has $11.7 billion in AUM. Other large interval funds include the BlackRock Strategic Income Opportunities Fund, the Vanguard Mortgage Backed Securities Fund, and the Pimco Flexible Credit Income Fund.

Risks & Considerations

Interval funds carry a variety of risks that investors should be aware of, such as liquidity risk, concentration risk, and legal/regulatory risk due to the fund's structure. Fees charged on an interval fund can include sales loads and redemption fees which are typically higher than those found in conventional closed-end funds. It is important to read all documents associated with the interval fund before investing so that potential investors can gain a better understanding of any additional costs or risks they may face when investing.

The Bottom Line

Interval funds are a type of closed-end fund that allow investors to sell their shares back to the fund at regular intervals. They can provide potential benefits such as diversification and lower fees compared to conventional closed-end funds, but also come with risks such as liquidity risk and concentration risk. Investors should carefully consider these risks before investing in an interval fund.