The Endowment Model Portfolio Strategy

Over the last 30 years, college endowments such as Yale have experienced significant growth thanks in part to their heavy allocation to alternative asset classes.

The endowment model portfolio strategy is a comprehensive investment approach that has been used by college and university endowments such as Yale, Harvard and Stanford for over 30 years. It uses a mix of non-traditional asset classes in order to achieve higher expected returns than the S&P 500 or other benchmarks while also providing risk diversification through different types of investments that do not always move in unison with one another.

History of Yale Endowment

In the 21 years since David Swensen's book Pioneering Portfolio Management was published in 2000, Yale has transformed its entire investment approach, reducing reliance on domestic marketable securities (US equity) and shifting towards alternative asset classes. Today, domestic marketable securities make up less than one-tenth of the portfolio, while foreign equity, private equity, absolute return strategies, and real assets form over nine-tenths of the endowment.

Over the past 30 years, The Yale Endowment has grown from $1 billion in 1985 to over $42 billion today. Compared to the median endowment, Yale's unique asset allocation has delivered an impressive 4.3 % per annum of outperformance. This growth has allowed Yale to provide generous financial support to its students and become one of the most prestigious institutions in the world.

Yale now ranks as the third largest endowment in the US:

- Harvard University - $53.1 billion

- University of Texas System - $43.6 billion

- Yale University - $42.2 billion

- Stanford University - $41.9 billion

- Princeton University - $35.8 billion

Benefits of the Endowment Model

The endowment model portfolio strategy has several advantages over traditional investment strategies (ie 60/40 portfolio).

- It provides a more diversified approach to investing, as non-traditional asset classes are less correlated with traditional asset classes, which can help reduce risk and increase returns over time.

- It allows investors to access alternative asset classes such as private equity, venture capital and real estate that are not typically available through mutual funds or other retail investments.

- The endowment model portfolio strategy is designed to be tax-efficient by utilizing low-cost index funds and ETFs in order to minimize taxes on gains from investments held for longer periods of time.

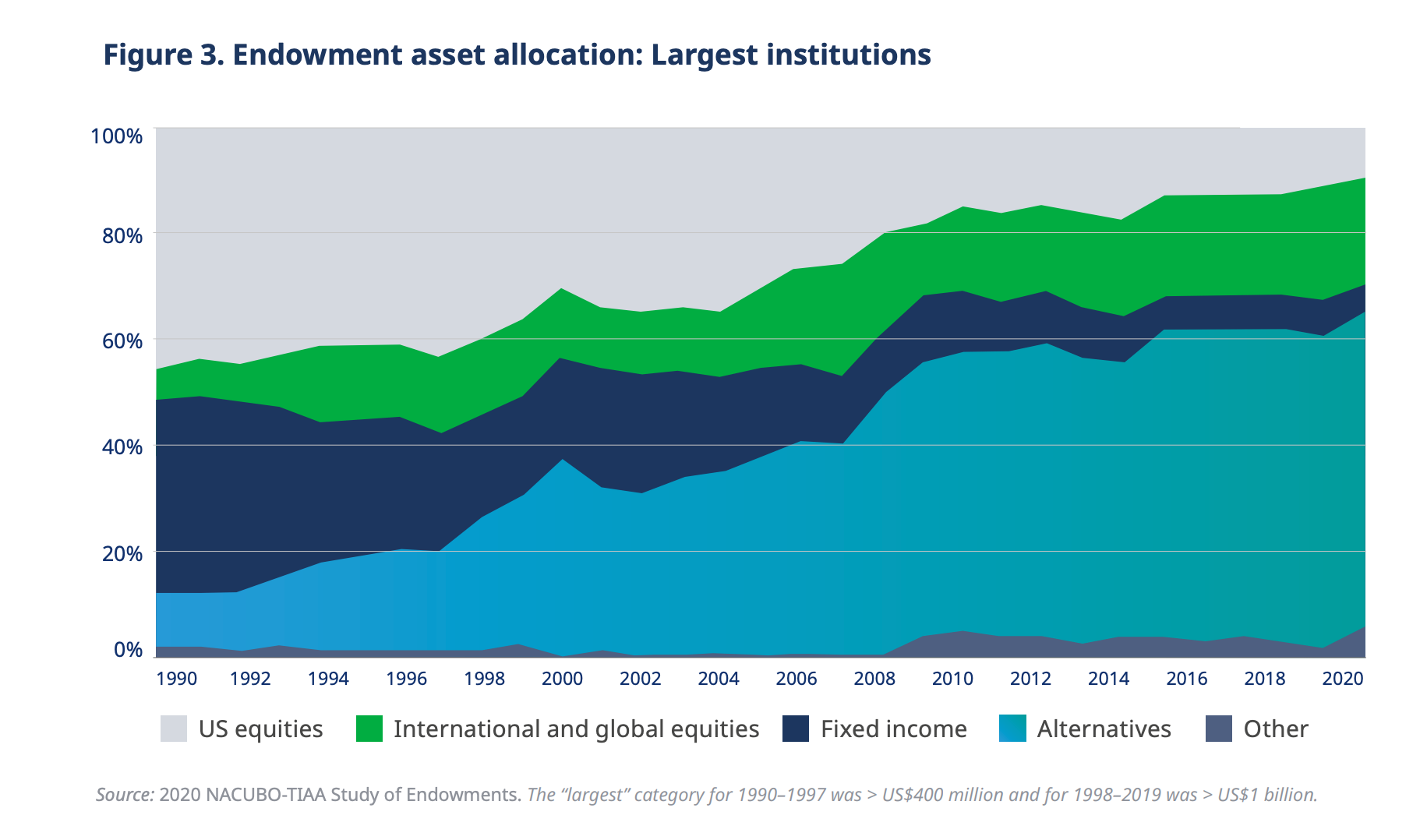

Decline in US Equity Exposure

The declining allocation to US equities is a reflection of the changing investment landscape. Endowments are increasingly investing in alternative asset classes, such as private equity and real estate. In fact, the share of US equities in most university endowments has fallen by half in the past two decades. According to a recent study by the NACUBO, the average allocation to US equities by university endowments has fallen from 30% in 2000 to less than 10% in 2023.

Increase in Alternatives Exposure

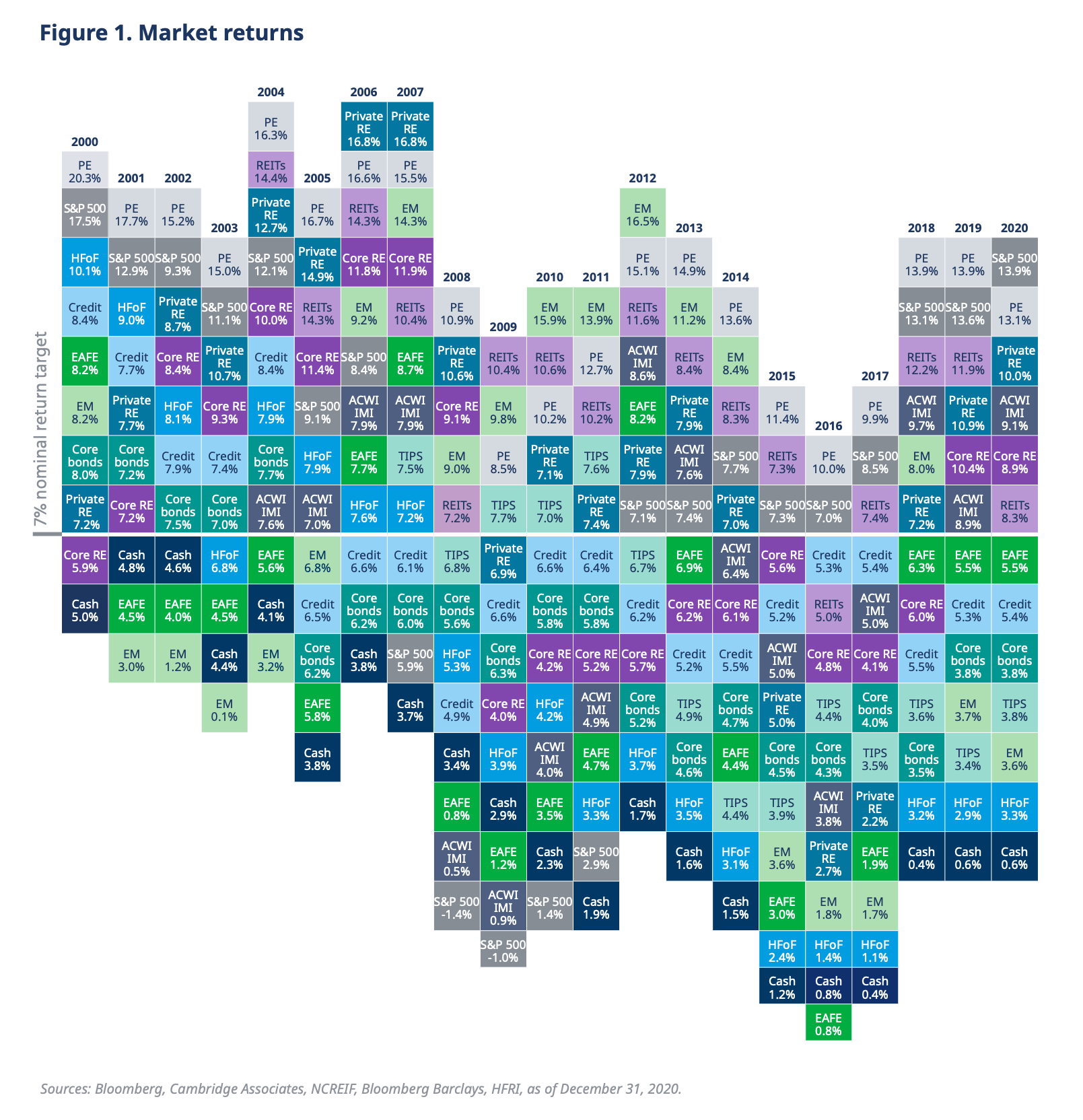

The reason for universities decreasing their exposure to US Equities becomes evident when considering the remarkable outperformance of private equity and other alternatives. Over the past 20 years, private equity has ranked as the top or second-best performer among all asset classes in an impressive 18 instances. Even more impressive, private equity has outperformed the 7% nominal return target in all 20 years, with 2009 being its worst year at 8.5% return.

Disadvantages to Consider

The complexity of creating an effective portfolio requires extensive research and active management to successfully implement, and the high minimums required for certain asset classes such as venture capital or private equity funds may make it difficult or impossible for individuals without large amounts of capital to replicate.

In terms of limited access, here are some stats to consider:

- The minimum investment for Blackstone's flagship private equity fund, Blackstone Strategic Partners, is $25 million.

- The minimum investment for Blackstone's real estate fund, Blackstone Real Estate Partners, is $100 million.

- The minimum investment for Blackstone's hedge fund, Blackstone Global Macro Fund, is $250 million.

Conclusion

The endowment model portfolio strategy stands as a powerful and successful tool, showcasing a history of prudent asset allocation decisions over the past 30 years. Notably, Yale's shift away from US equity exposure in favor of private equity and alternatives has been a contributing factor to its outperformance. However, this strategy may not be suitable or accessible for all investors due to complexity and high minimums required by certain asset classes.