Blackstone Makes History with $1 Trillion Milestone

Blackstone has become the first ever private equity firm to reach $1 trillion in assets under management.

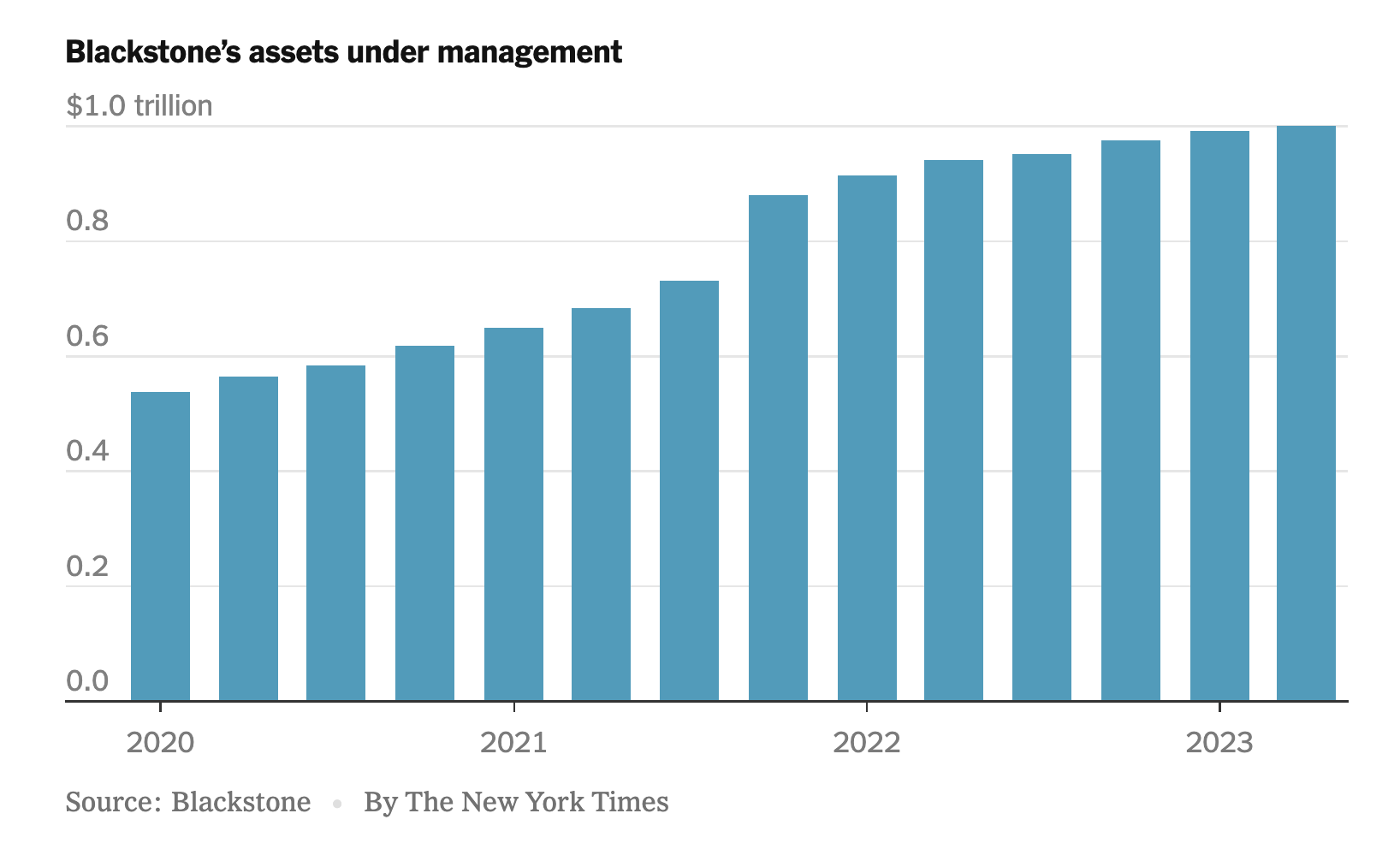

Blackstone, which began as a two-person shop in 1985 overseeing $400,000, has become the first ever private equity firm to have over $1 trillion in assets under management (AUM). This milestone marks a significant achievement not only for the firm but also for the broader industry of alternative asset management.

The world's largest investment management company reported Q2 EPS of $0.93, in line with industry estimates, but down 38% YoY. Revenue for Q1 came in at $2.81 billion, surpassing expectations. The company achieved a net income of $601.3 million, a significant improvement from the previous quarter's net loss of $29.4 million. It currently holds approximately $195 billion of unspent capital and declared a quarterly dividend of 79 cents per share.

The firm's AUM has grown by more than 50% in the past five years, and grown over 222% over the past 10 years. Their total AUM increased by 46% in the second quarter of 2023 alone, accompanied by $30.1 billion of inflows during the same period. Their impressive growth can be attributed to several key factors:

- Blackstone's strong performance across various investment strategies, including private equity, real estate, credit, and hedge funds.

- Strong inflows of capital from investors, which include pension funds, endowments, sovereign wealth funds, and high-net-worth individuals. These investors are increasingly turning to alternative asset managers like Blackstone in search of stable and long-term returns.

- Blackstone's private equity business experienced strong growth, with a 20% increase in performance fees, primarily driven by secondary sales.

- Blackstone's innovative approach and focus on diversification have allowed the firm to expand into new markets and asset classes. Blackstone has identified growth opportunities in private credit, insurance, infrastructure, energy transition, life sciences, Asia, and wealth management.

Despite the significant achievement, Blackstone has faced challenges, such as a decline in their second-quarter distributable earnings by 39% due to declining asset sales. Concerns about debt costs and plunging office occupancy rates also spurred investors to pull their money from Blackstone’s flagship real estate fund. However, the firm still remains optimistic about future growth opportunities and is taking strategic steps to manage these challenges. For instance, Blackstone has been partnering with distressed regional banks, amounting to over $6 billion, to provide lending for home improvement, auto finance, and renewable energy.

In conclusion, Blackstone's $1 trillion AUM milestone is indeed a significant achievement, and it reflects the firm's strong performance and resilience amidst various challenges. With a global presence and diverse investment strategies, Blackstone is well-positioned for future growth and likely to continue playing a leading role in the global alternative asset management industry.