How Model Portfolios Drive Growth for Advisors

A model portfolio is a pre-built investment portfolio designed to meet an investor's specific needs, incorporating factors such as risk tolerance, goals, and time horizon.

In the dynamic world of investing, both individual clients and financial advisors seek effective strategies to achieve their financial goals. Model portfolios emerge as a powerful tool, offering clients a well-crafted asset allocation strategy and diversified, low-cost portfolios. In this article, we delve into the concept of model portfolios, how they empower both investors and advisors.

Background

The assets under management (AUM) in model portfolios have experienced remarkable growth, surging from $1 trillion in 2015 to $2.6 trillion in 2023. This number is expected to grow to $3.6 trillion by 2025. This exponential rise can be attributed to several factors, including the advent of robo-advisors, the increasing complexity of the investment landscape, and investors' growing appetite for simplicity and diversification in their portfolios.

BlackRock is currently the top provider of model portfolios, according to Morningstar research, managing $1.3 trillion of assets through its models, followed by Vanguard at $1.1 trillion, State Street Global Advisors at $750 billion, and Fidelity Investments at $500 billion.

AUM in Model Portfolios

- BlackRock $1.3 trillion

- Vanguard $1.1 trillion

- State Street Global Advisors $750 billion

- Fidelity Investments $500 billion

- Dimensional Fund Advisors $350 billion

- JPMorgan Chase $300 billion

- Wells Fargo $250 billion

- Northern Trust $200 billion

- T. Rowe Price $150 billion

- Wilshire Associates $100 billion

According to a 2022 report by Envestnet, 62% of RIAs use model portfolios for their clients, and this number is expected to grow to 75% by 2025. Generally, advisors may favor model portfolios for clients with lower risk tolerance and higher fee sensitivity, as these portfolios typically consist of low-cost index funds. Such model portfolios have gained popularity among advisors seeking to provide a diversified investment approach while keeping costs down for their clients.

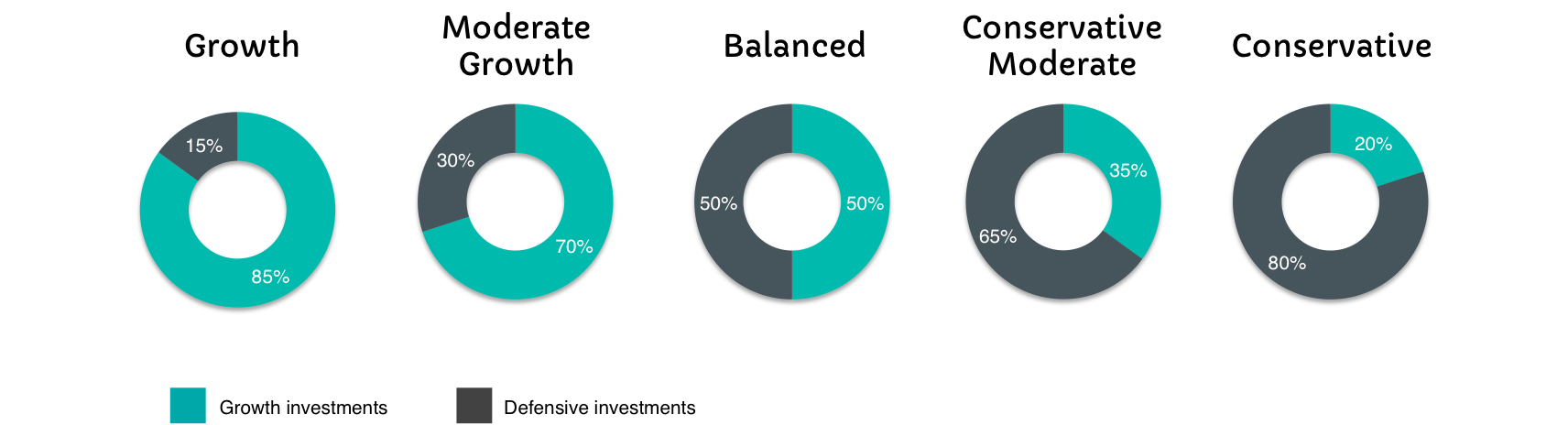

Advisors that use model portfolios typically create 5-8 models, spread across a risk spectrum from 1 to 100, depending on the mix of clients they serve. The advisor then adjusts the portfolio to fit their client as they wish. Advisors will aim to have a Risk Score of 50 correlate to a Balanced investment approach. The higher the Risk Score, the higher the risk tolerance, the more aggressive the strategy.

Driving Outperformance

Over the past decade, model portfolios have delivered strong performance, with an average annual return of approximately 7%, outpacing the S&P 500 which stands at around 6%. This performance underscores the effectiveness of model portfolios in generating attractive returns for investors in many market environments.

Model portfolios are renowned for their inherent diversification. By encompassing a mix of asset classes, such as stocks, bonds, and cash, these portfolios help reduce risk and volatility. The broad diversification provides investors with a shield against the potential impact of market fluctuations.

Model portfolios are carefully monitored and rebalanced on a regular basis. This dynamic process ensures that the portfolio's asset allocation remains aligned with the investor's risk tolerance and long-term investment goals. Through rebalancing, model portfolios maintain their strategic focus and optimize performance.

Weighing the Pros and Cons

When considering investment strategies, it is important to evaluate the benefits and limitations of model portfolios. These portfolios offer effective risk management through diversification across asset classes, simplifying the investment process, and providing professional management and monitoring. However, there is a potential drawback of over-concentration in public markets, limiting exposure to other asset classes, and a lack of tailoring to individual needs, risk tolerance, and investment objectives.

Advantages of Model Portfolios

- Simplicity and Accessibility: Model portfolios are an excellent option for investors seeking a hands-off approach to investing. They provide a comprehensive investment strategy, saving investors time and effort while offering accessibility to sophisticated investment methodologies that might otherwise be complex to implement.

- Expert Insights and Analysis: Model portfolios are meticulously designed by seasoned experts in the industry. Financial advisors and investment managers leverage their professional expertise and extensive research to curate portfolios that align with investors' financial goals. This in-depth analysis ensures that each investment is carefully evaluated and selected to drive optimal results.

- Leading Asset Managers: The top asset managers dominating the model portfolio landscape include BlackRock, Vanguard, State Street Global Advisors, Fidelity Investments, and more. These industry giants bring their vast experience and resources to bear in constructing model portfolios that combine diverse asset classes and investment strategies.

- Cost Savings. A study by Morningstar found that the average expense ratio for model portfolios was 0.5%, compared to 1.5% for actively managed mutual funds. This means that investors using model portfolios could save an average of 1% per year on their investment fees.

Disadvantages of Model Portfolios

- Limited flexibility. Model portfolios are designed to be broadly applicable and may not accommodate specific investment preferences or unique financial goals. Custom portfolios, on the other hand, offer more flexibility in tailoring the portfolio to individual needs, risk tolerance, and investment objectives.

- Lack of individualized risk management. Model portfolios follow predetermined asset allocation strategies that may not fully align with an investor's risk tolerance or changing market conditions. Custom portfolios, on the other hand, allow for more personalized risk management strategies and the ability to adjust the portfolio as market dynamics evolve.

- Potential for inefficiencies: Model portfolios are designed to be scalable and applicable to a large number of investors, which may result in holding assets that are not optimally aligned with an individual investor's preferences or tax considerations. Model portfolios may also have similar holdings, which can lead to unintended concentration in certain sectors or asset classes.

Conclusion

Model portfolios have revolutionized the investment landscape, empowering both investors and advisors with their simplicity, diversification, and strong performance track record. With a remarkable growth trajectory and the ability to align investment strategies with individual goals, model portfolios offer a compelling solution for investors seeking financial success. By partnering with financial advisors and leveraging the expertise of leading asset managers, investors can harness the potential of model portfolios and navigate the complexities of investing with confidence and clarity.