Mutual Funds vs. ETFs - Which to Choose?

Mutual funds and ETFs share many similarities; both funds are comprised of diverse asset portfolios, making them popular choices for investors seeking diversification.

Introduction

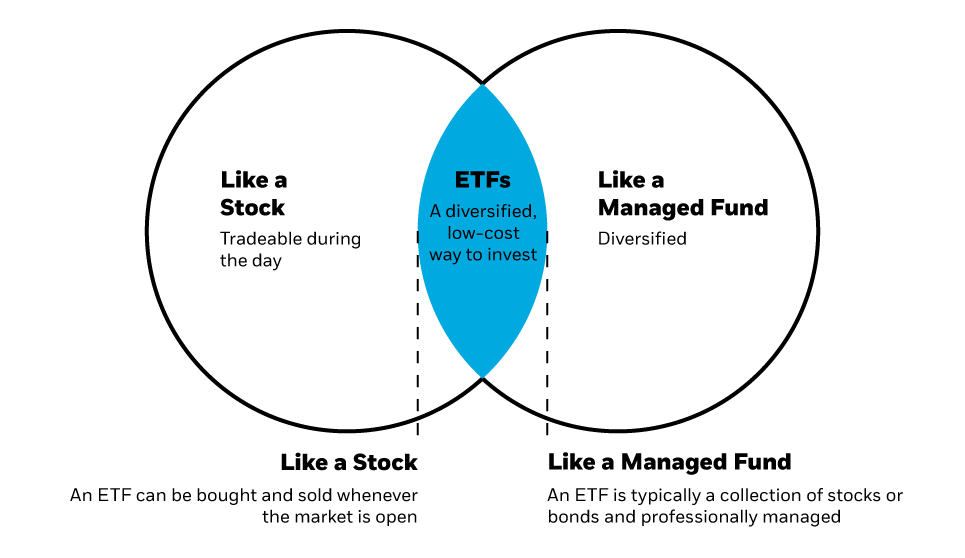

Mutual Funds and ETFs are two popular investment options for investors seeking diversification, as both funds comprise of diverse asset portfolios. These types of investments offer a variety of benefits to those looking to increase their risk-adjusted returns, though they also come with certain risks that should be taken into account before making an investment decision.

Breakdown of Mutual Funds

Mutual funds offer investors diversification through a portfolio comprised of multiple assets, but also come with high fees and limited flexibility when it comes to trading activity. Investors typically buy and sell mutual fund shares at the fund's net asset value (NAV) at the end of the trading day, after the market has closed. This means that investors cannot take advantage of intraday price movements and may not have immediate access to their funds in case of emergencies. Additionally, mutual funds may have certain restrictions, such as high minimum investment requirements and long holding periods.

Breakdown of ETFs

ETFs are traded on an exchange, just like stocks. ETFs offer numerous benefits over mutual funds, including lower costs, higher tax efficiency, and enhanced liquidity on stock exchanges. These advantages stem from their passive management approach and ability to closely replicate their underlying index performance. However, investors should be mindful of potential risks—such as extreme market volatility and tracking errors that may cause discrepancies between ETF returns and their intended index performance.

Assets Under Management

The total assets under management (AUM) of ETFs has grown significantly over the past 10 years, with a compound annual growth rate (CAGR) of 15%. In contrast, the AUM of mutual funds has grown at a slower pace, with a CAGR of 7%. However, AUM of mutual funds remains nearly four times larger at $22.1 trillion, compared to the AUM of ETFs at $6.5 trillion.

Year Mutual Funds ETFs

2023 $22.1 trillion $6.5 trillion

2020 $20.7 trillion $3.9 trillion

2010 $16.4 trillion $800 billion

2000 $11.4 trillion $100 billion

Conclusion

Mutual funds and ETFs both offer investors advantages in diversification, cost, tax efficiency, and liquidity. However, it is important for investors to research their options thoroughly before deciding which investment vehicle best fits their portfolio needs. Ultimately, each individual investor must determine the most suitable type of fund based on their own risk tolerance and financial goals.